Venture vs. Visionary

Venture Way vs. Visionary Way

The business building road you choose is critical. To date, venture capital and angels insist entrepreneurs take one road and only one road – the Venture Way. According to the research, driving the start-up down this road has been a disastrous journey 8 out of 10 times – that’s the bad news. The good news is there is another highway to take – the Visionary Way.

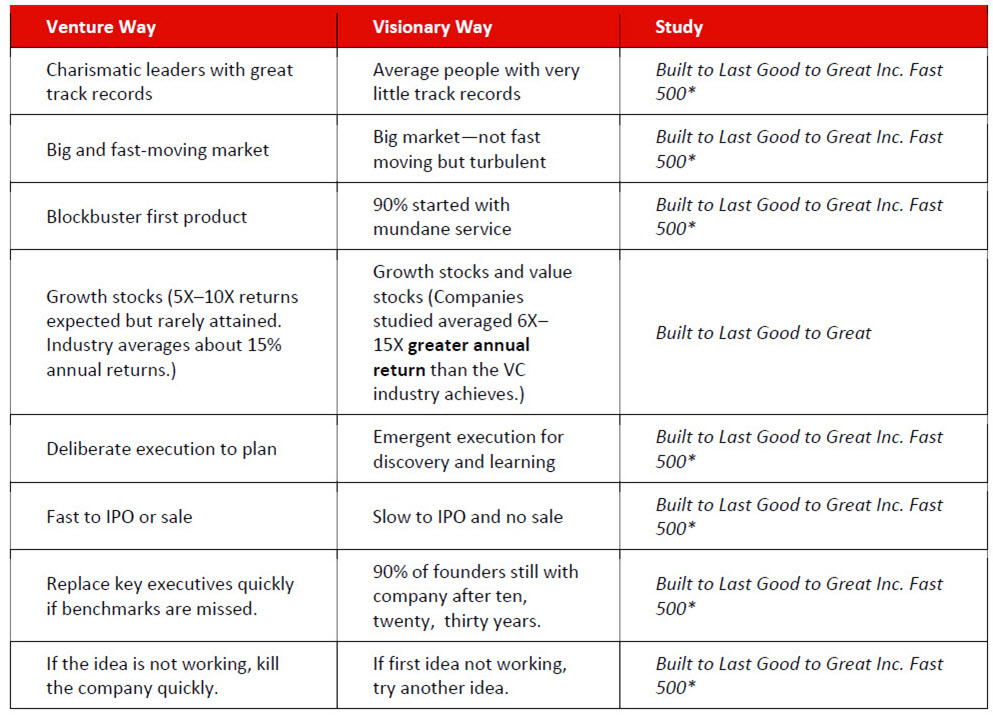

There is no shortage of books and curriculum about how to access angel and modern venture capital financing. Our task is not to repeat the fine material on the subject. Sometimes these policies and practices are explicitly published by angels and VCs. More often the following policies and practices are implicit and unpublished. Regardless, these policies and practices shape the way any new venture launches if its investors are angels or modern VCs. Figure 1 shows the eight policies and practices that make up the philosophy of the Venture Way model. These eight policies and practices suggest that the Venture Way is very much a project-or one-product-based business-building experience. Venture Way businesses are short term and have to take advantage of immediate opportunities. They are deliberate planning and execution-based attempts to start, finance, and exit quickly after exploiting one idea. The entire justification for the business rests on financial success (this is neither right nor wrong—it just is). Predicting success is largely done by assessing current category circumstances. Most assumptions about the future have to be verifiable up front. Patience by investors is in short supply. Jim O’Connor, former Director of Motorola’s Intellectual Property Incubation and Commercialization and former head of Motorola’s venture fund, describes the philosophy underlying Venture Way businesses the best: “if an idea is not working, kill it.”

- Charismatic leaders with great track records1

- Big and fast-moving market2

- Blockbuster first product3

- Growth-stock not value-stock-based companies. Deliberate execution to plan Fast to IPO or sale4

- Replace key executives quickly if benchmarks are missed If the idea is not working, kill the company quickly

2 Older larger VC firms want market size to be 500 million plus. Newer smaller VC firms accept market size to be 200 million plus.

3 Any VC wants market share to be at least 25%.

4 Older larger VC firms want $100 to $300 million revenue stream within five years and IPO exit. Newer smaller VC firms accept $60 to $80 million revenue stream within five years and sale or IPO exit.

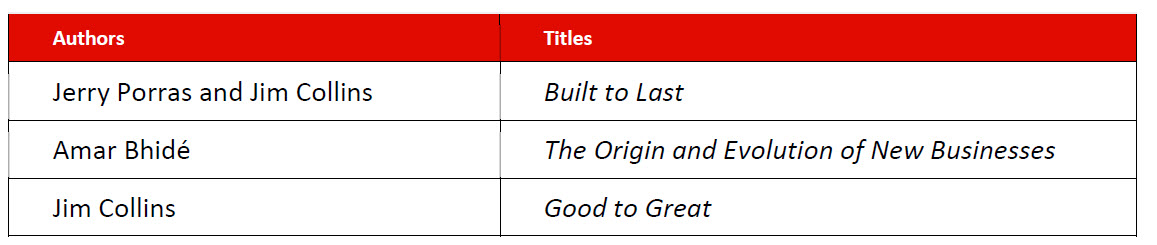

These three studies have the following similarities:

- University centered—Stanford, Harvard, Colorado

- Led by professors widely respected in business research supported by research staffs

- Took over five years to complete

- Resulted in best-selling business books

- Appeared on the covers of popular business magazines

Two of these studies, Built to Last and Good to Great, examined the success traits of public companies that have persevered and profited over many years and through many industry cycles. The third study, The Origin and Evolution of New Businesses, put 100 of America’s fastest growing private companies under the microscope, from their launch through their tenth year. Over 50 percent 50% of these companies were in the teleco, computer, and medical industries—typical venture capital sectors. The average company on the Inc. Fast 500 list had revenues of $15 million, 135 employees, and a five-year sales growth of 1,407% or 281% per year. The companies researched were not all technology companies. However, enough of them were. Figure 2 identifies the five disciplines of the Visionary Way.

- Tier 2 leadership

- Authentic core drivers

- Build organization first

- Hold two opposed ideas at once and remain functional

- Systematically innovate and transform

Table 1