WHY WE ARE HERE

The LabX journey started several years ago when our Founders asked a very profound question:

“What if we think differently and reduce the uncertainty involved in venture start-up investing and develop a new paradigm where investors consistently pick winners most of the time?”

By using advanced scientific methods and advanced technologies including Artificial Intelligence, Machine Learning, Pattern Recognition, Algorithms and Venture Analytics, we have engineered a new future for venture funding as a leader in the field of Venture Science.

• NASA thought differently and solved the problem of putting the first man on the moon.

• Steve Jobs thought differently and created a new category of smartphones.

• Google used science and technology to create the fastest and deepest search engine.

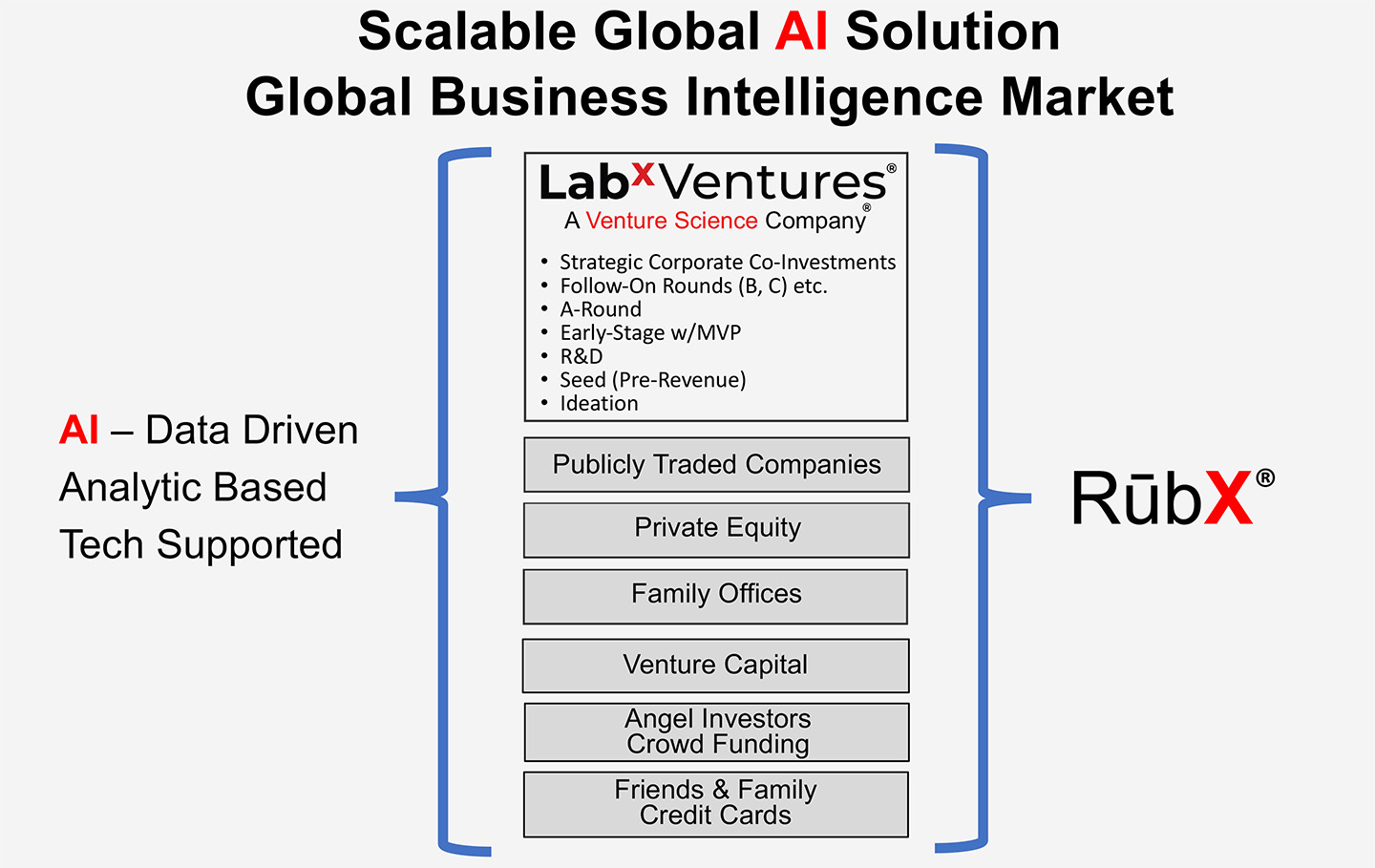

Now, LabX has created a game-changer with our proprietary Venture Assessor, RūbX® to find winning investments.

Warren Buffett famously said, “Risk comes from not knowing what you’re doing.” Our powerful assessor tool helps us to eliminate subjectivity when selecting venture start-ups by applying the principles of Venture Science to support our platform and craft predictable outcomes.

Our objective is to share our breakthrough platform and methodologies to solve the problem of selecting the best startup and emerging growth opportunities thereby creating above average returns for our entrepreneurs and their investors.

OUR TECHNOLOGY

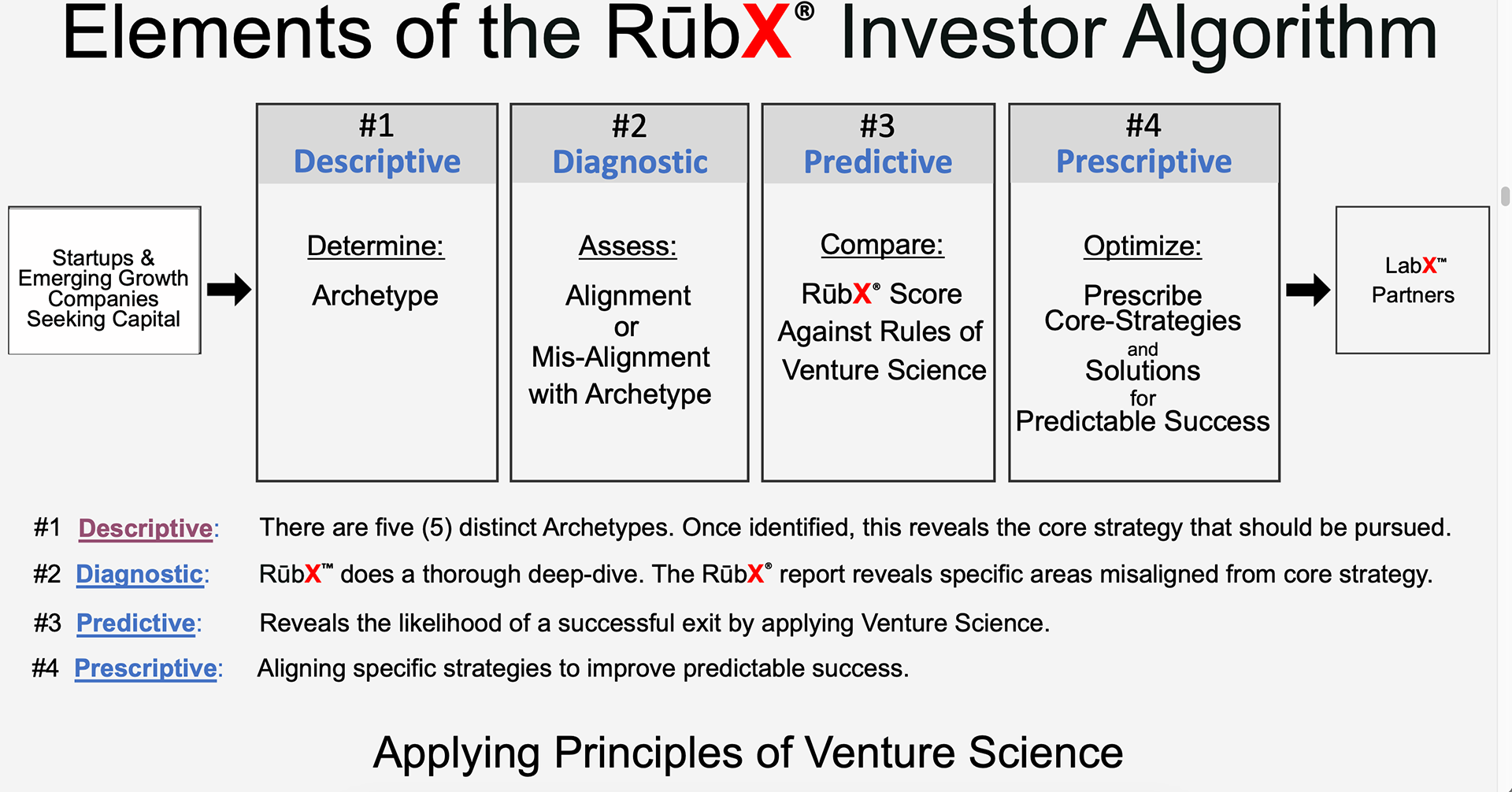

Our assessor is comprised of four core elements and steps. Each element in the assessment process is a critical part of the LabX platform:

Our Venture Assessor, RūbX® is in-depth, rigorous and includes:

• up to 150 query levels

• up to 600 sub-levels

• allows for over 5,000 points of information to be analyzed and scored

OUR METHODOLOGY

Our Venture Assessor, RūbX® is driven by a complex rules-engine, always improving and learning with AI procedures crafted and implemented by our top-tier tech team’s know-how. We have created an objective evaluation that yields a predictive, FICO-like score for every start-up company we assess to help us decide whether that start-up is a strong candidate for investment.

Google’s former CEO, Eric Schmidt, who predicts the future importance of rules engines like ours said,

“2010-2020 will be a period known as the Third Decade of the Web (web 3.0). Experts agree that the missing piece in the Web 3.0 infrastructure will be the rules engines that enable business intelligence…to finally have a chance to deliver on their long-awaited promises“

Not only does our assessor screen and select companies for our portfolio, it has the power to make specific scientifically-based prescriptive recommendations for the advancement of the company and its outcomes. These prescriptive elements of our platform are supported by subject matter experts through collaborative problem-solving sessions in our Venture Innovation Lab using respected, proven tools like Group Genius and TRIZ. (see our LAB section)

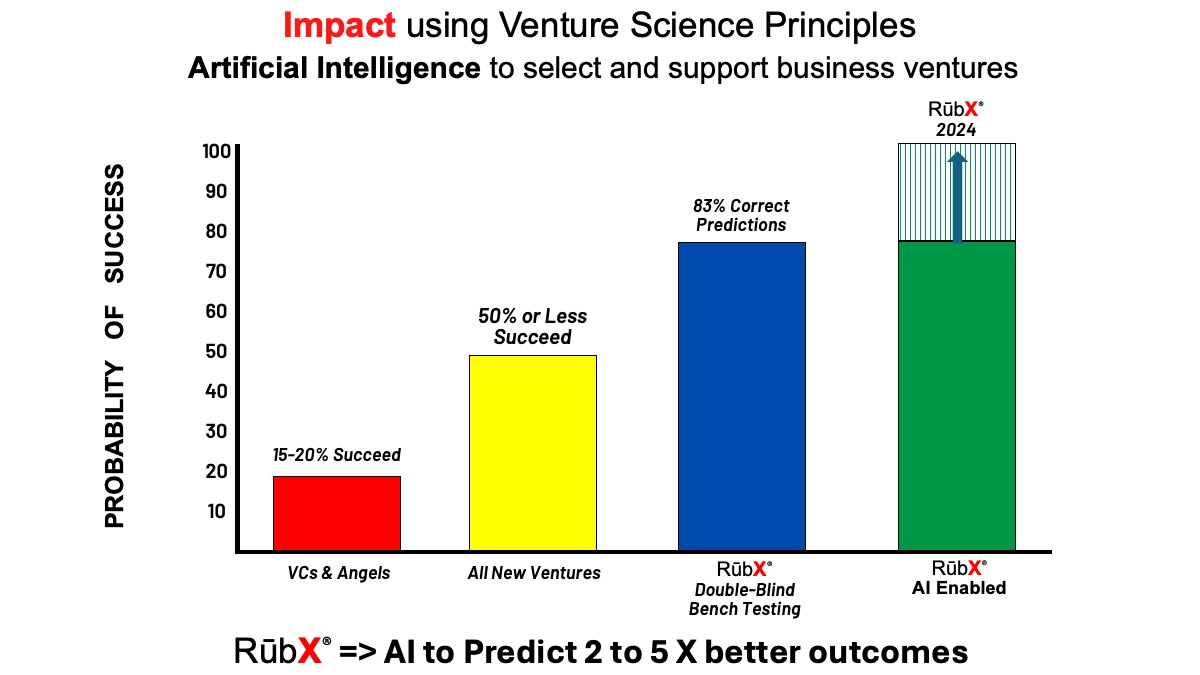

Published university- and law firm-led double-blind testing of an earlier manual version of our Assessor shows that we can expect the number of successful exits in our fund to be substantially better than funds outside of the LabX platform. The reason is simple – most other funds lack a scientific and objective assessor, follow-on innovation tools, or a cooperative platform.

Our deep Assessor platform, RūbX®, with its Rules based/AI hybrid technology, along with its FICO-like predictive capabilities, selects ventures for possible direct investment or co-investment with our strategic investor alliances. We then enhance and advance our portfolio companies outcomes and profitability in our Venture Lab.

OUR PLATFORM

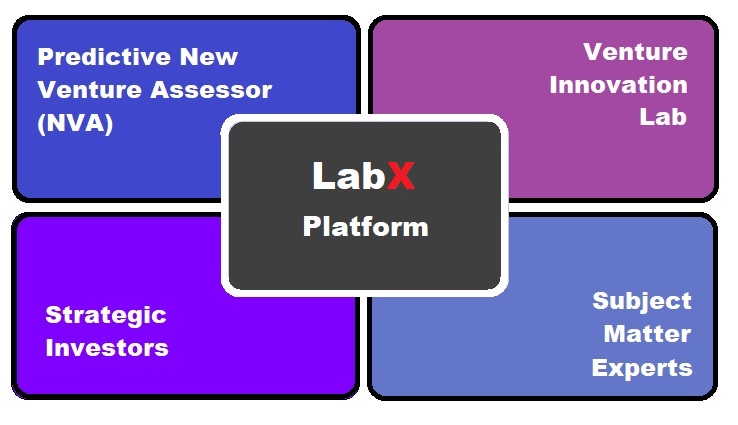

LabX Ventures® is a Platform Business Model with a Whole Product Solution. In other words, LabX is a complete, turn-key system that supports an entire venture, from start-up assessment and screening to exit.

Our platform constructs an alliance between entrepreneurs, strategic investors and innovation experts.

One MIT Sloane Business Review economist aptly stated that a Platform Business Model must “…solve a real problem for both groups you seek to connect. You have to be enabling something that wasn’t there before — and it’s got to be a sufficiently big thing that the outcome is good for Group A, and it’s good for Group B.”

Our platform involves input and cooperation from venture candidates and entrepreneurs, strategic investors, alliance partners, our assessor software system, our Venture Innovation Lab and a myriad of subject matter experts and known opinion leaders. Every partner benefits. Our platform is complex, objective and driven by science. We expect that the number of investments that see successful exits could be substantial.

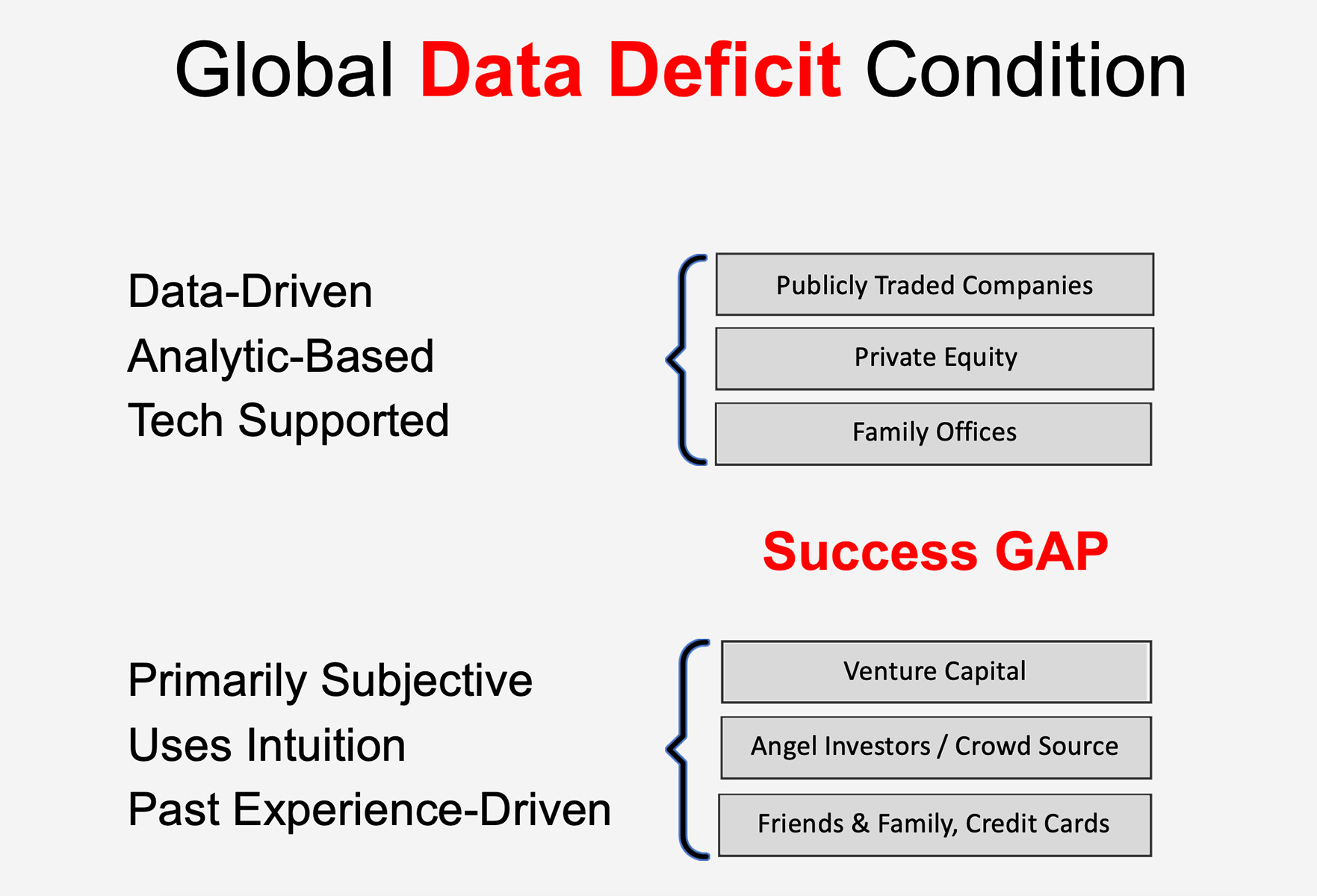

VENTURE SCIENCE CAPITAL IS DATA-DRIVEN

It’s a new way of objectively, scientifically and algorithmically finding, selecting, funding and growing promising technology start-ups that to date, only the big-dollar asset classes have had the luxury of following. Now LabX Ventures® is leading the way in a different asset class driven by science: Venture Science Capital.

PUBLISHED RESEARCH & TESTING

Our assessor has been tested in two, separate double-blind studies, one of which was conducted at the University of Texas in Austin. The first formal test of our analytic was conducted and analyzed by Silicon Valley’s preeminent venture law firm of Wilson Sonsini, with stringent oversight by other independent entities.

Wilson Sonsini Facility

Silicon Valley, California

The results of this challenge:

We successfully predicted the viability of these investments with

83% accuracy.

This time, we correctly predicted—with over 80% accuracy—whether investors would have a high R.O.I. within 7 years.

University of Texas

Austin, Texas

We’re not the first to finally use measurable, empirical data to analyze potential start-ups, but we are the only process we know of that has been scientifically vetted with two independent double-blind tests (n=19), as well as hundreds of actual evaluations of critical planning elements with real-world companies. See links below for a copy of the Final Report issued by the University of Texas Business School and IC2 Institute.

CONSULTED ● TESTED ● TAUGHT