The LabX Ventures® journey started several years ago when our Founders asked a very profound question:

“Because millions of early-stage companies annually seek business funding and 80%-90% of those companies fail, what if we could create an efficient, scalable, assessment process to enhance venture investment decisions?”

Utilizing principles of Venture Science, LabX Ventures® has created an automated due diligence assessor called RūbX® for investment allocators who desire an automated decision-making support tool.

Warren Buffett famously said, “Risk comes from not knowing what you’re doing” and our powerful application reduces subjectivity with data while efficiently scoring and organizing companies that seek funding.

The Venture Science Automated Due Diligence Assessor

LabX Ventures® pioneered RūbX®, a next-generation platform designed to automate the most time-consuming parts of venture due diligence.

Our system utilizes agentic AI orchestration to analyze structured documents and generates consistent, repeatable, evidence-based assessments of early-stage companies, enabling investors to make faster and more rigorous decisions.

RūbX® assesses materials that represent typical investor communications, including:

Pitch decks

Business plans

Intellectual Property

Competitive Landscapes

Cap tables

Financial statements

Market research

Team bios

Legal and compliance documents

RūbX® Key Objectives

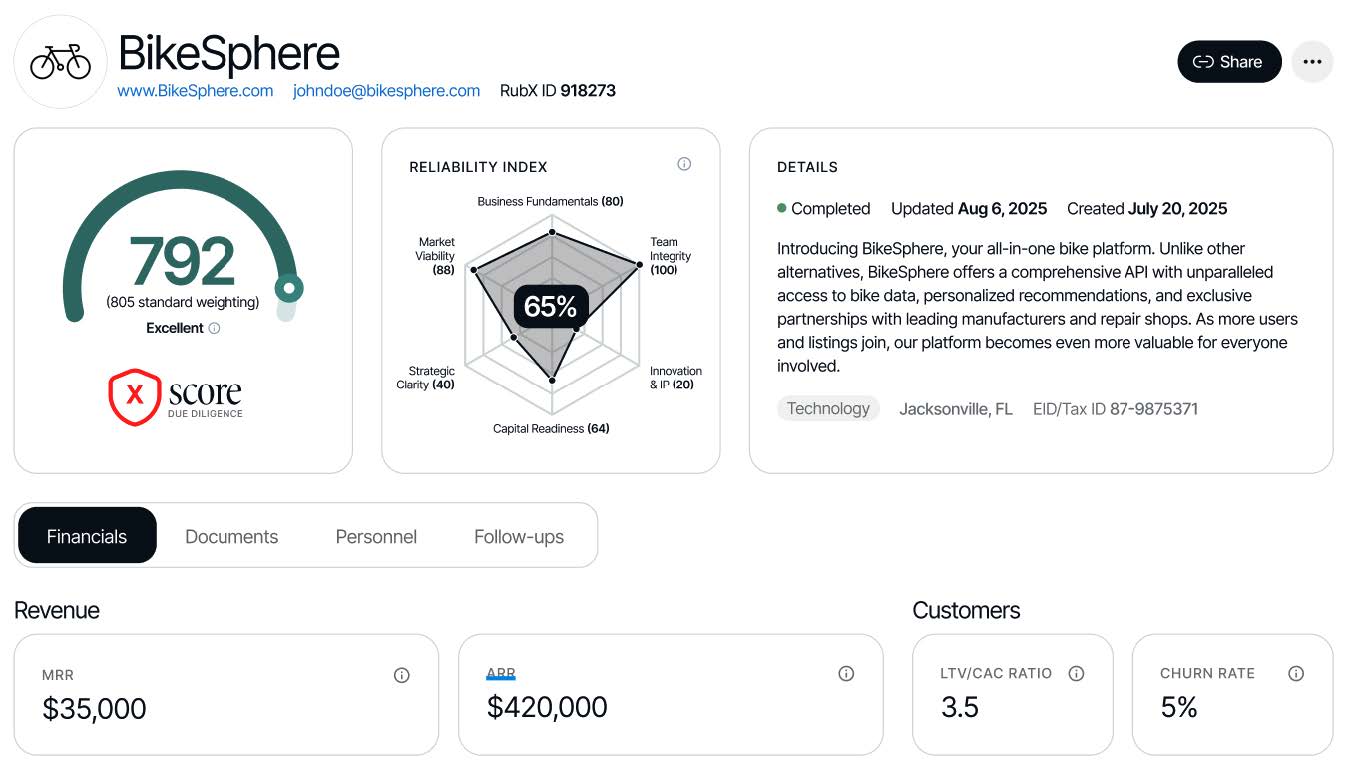

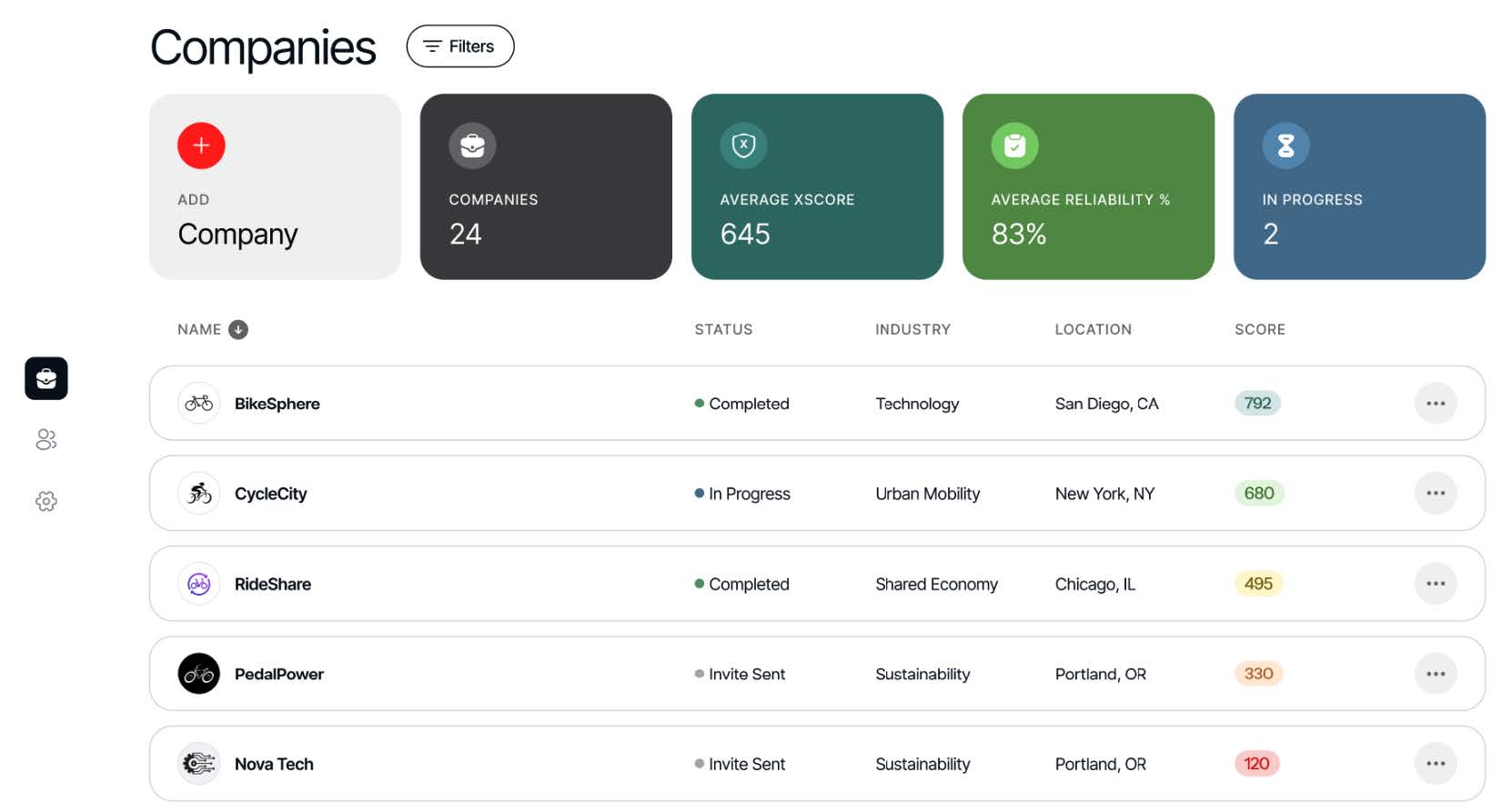

· Automated Due Diligence at Scale: Utilizing a digital dashboard, the allocator has an overall picture of a company profile, and one click access to individual company documents as well as quick access to a comparative database of early-stage company information collated for efficient review and competitive comparisons.

· Relative Value: Using the RūbX® with RI as a benchmark, allows side by side comparisons of similar or dissimilar companies when considering investment allocations.

· Track Changes: Because the RūbX® algorithm is stable and evidence based, quarterly document updates will be reflected in the score allowing allocators to track company progress.

Tracking Investment Options

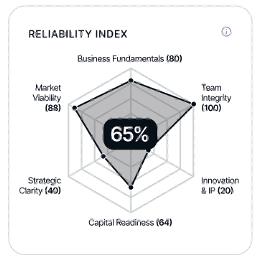

· The Reliability Index (RI) is a numerical rating that reflects the extent to which the assessment is based on complete and comprehensive data. It quantifies the level of confidence in the RūbX® by considering the proportion of data points available versus those missing.

Data-Driven Depth

· Multiple orchestrated AI Agents process key business documents: Business plans, pitch decks, financial documents, competitive assessments, etc.

· The agents draw from structured and unstructured sources to build a comprehensive investment profile with scored results.

Calculated Evidence Based Scoring

· The output is a RūbX® , akin to a FICO® credit score.

· RūbX® also delivers the Reliability Index (RI) for added transparency and confidence.

Hybrid Intelligence

· Combines principles of venture science and rule-based algorithms.

· Continuously refines its assessment logic using real-world outcomes and feedback loops.

Scientifically Validated

· Early development included technology consultants and double-blind trials led by Wilson Sonsini and University of Texas researchers, demonstrating superior accuracy compared to subjective assessments.

Why Incorporate Venture Assessment Analytics

• Improves Investor Confidence: By standardizing the assessment process, structuring data, and adding a fiduciary component via RūbX® ![]() with RI, decision-making processes are enhanced with access to value-enriched information.

with RI, decision-making processes are enhanced with access to value-enriched information.

• Speeds Due Diligence: Automated analysis enables rapid evaluation at scale—hundreds or even thousands of ventures can now be reviewed with deeper insights than typical manual processes.

• Empowers Action: Every business assessment comes with evidence-based trackable changes through the RūbX® ![]() with RI supplementing each allocator investment thesis. Information and an independent assessment minimize subjective decision-making to enhance evidence-based investment management.

with RI supplementing each allocator investment thesis. Information and an independent assessment minimize subjective decision-making to enhance evidence-based investment management.

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.